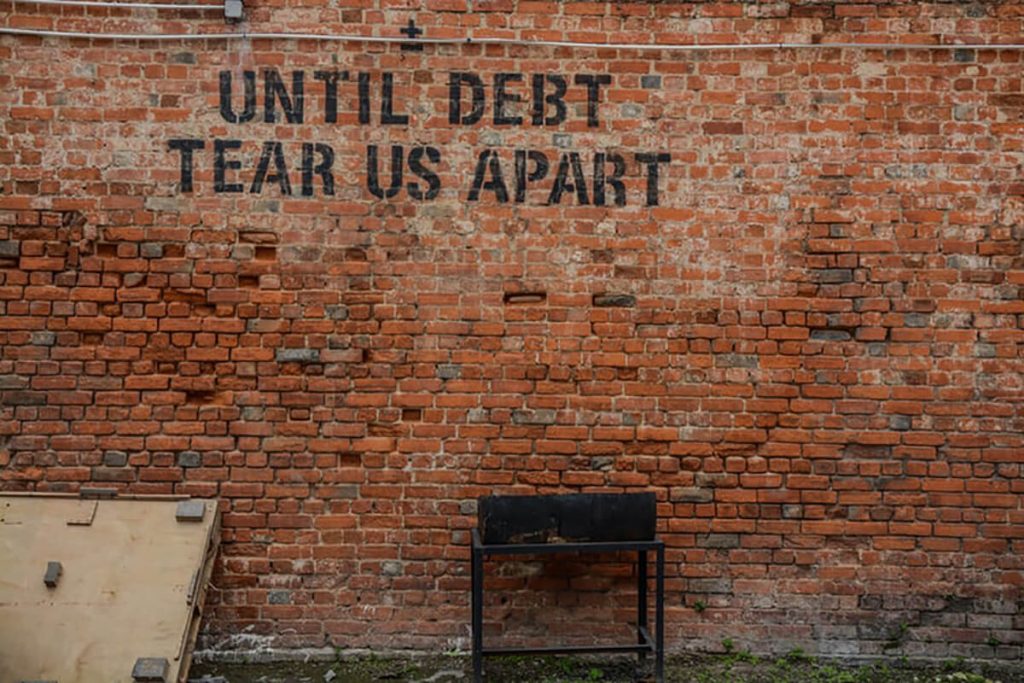

Financial infidelity is a term you may not have heard before—or maybe you’ve never even considered the concept. It’s defined as the secretive act of possessing credit and credit cards, spending or borrowing money, holding secrets about a bank account or stashes of money, or incurring debt unknown to one’s spouse or partner. This trend, although rarely talked about, continues to grow exponentially.

Financial infidelity is a term you may not have heard before—or maybe you’ve never even considered the concept. It’s defined as the secretive act of possessing credit and credit cards, spending or borrowing money, holding secrets about a bank account or stashes of money, or incurring debt unknown to one’s spouse or partner. This trend, although rarely talked about, continues to grow exponentially.

The Statistics

Research conducted in 2012 by Self.com and Today.com who surveyed almost 24,000 men and women found:

-Almost 50 percent of married adults admitted to keeping money secrets from their spouses.

-37 percent of men and 56 percent of women admitted to lying to their partner about money.

-63 percent of men and 70 percent of women agreed that being honest about money was as important as being monogamous.

-31 percent of couples had committed financial infidelity.

One in ten: That’s the ratio that people admit to having hidden credit card purchases, which have played a role in their separation or divorce, according to a report by Moneysupermarket.com and reported in the article, Secret Credit Card Spending and Divorce Linked in New Survey.

Warning Signs

According to Adrian Nazari, Founder and CEO of CreditSesame.com, and further discussed in the Huffington Post article, Financial Infidelity: What To Do When Someone Cheats, there are three warning signs of potential financial infidelity: suspicious withdrawal, changing the topic when money issues come up, or a partner who wants to totally control the finances. A person should also be on the lookout for their partner insisting on secret passwords for online banking accounts, or having separate credit cards.